On the evening of December 18, Beijing time, Nippon Steel and U.S. Steel jointly announced that Nippon Steel would make a pure cash acquisition of U.S. Steel at a price of US$55 per share. The offer represents a nearly 40% premium to last Friday’s closing price of $39.33. The transaction has been unanimously approved by the boards of directors of Nippon Steel and U.S. Steel.

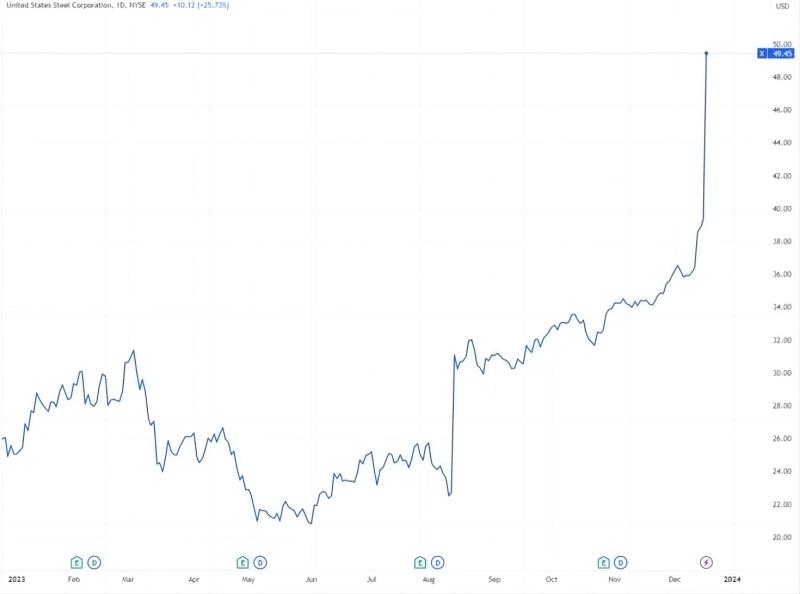

According to U.S. Steel, the US$55 offer corresponds to an equity value of US$14.1 billion. Taking into account the debt assumed, the enterprise value corresponding to this acquisition will reach US$14.9 billion, equivalent to more than 2.1 trillion yen. In fact, U.S. Steel's stock price has been fluctuating in recent months following acquisition rumors. Since Cleveland-Cliffs, the largest flat steel producer in the United States, made an acquisition offer of nearly US$7.3 billion on the 8th of this year, the company's stock price has doubled.

Nippon Steel's Acquisition of U.S. Steel Faces Strong Opposition from Many Parties

According to the merger and acquisition plan given by Nippon Steel, U.S. Steel is expected to hold a shareholders' meeting in March next year. Based on the approval of the company's shareholders and regulators, the transaction is expected to be completed in the second quarter or second quarter of next year. Michael Leiter, head of CFIUS and national security practice at Skadden, Arps, believes CFIUS is "unlikely" to block a deal with a country as close to a U.S. government as Japan, despite growing political opposition to the deal among politicians and unions. Allies reach a deal.

Asked about the proposed deal during a White House press briefing on Tuesday, White House press secretary Jean-Pierre declined to comment specifically on the acquisition.

CNN said that despite political opposition, the fate of U.S. Steel Corp. being sold to Japanese capital is basically a certainty. This has sounded the alarm to the current global corporate giants. The world is changing so fast that it is jaw-dropping.